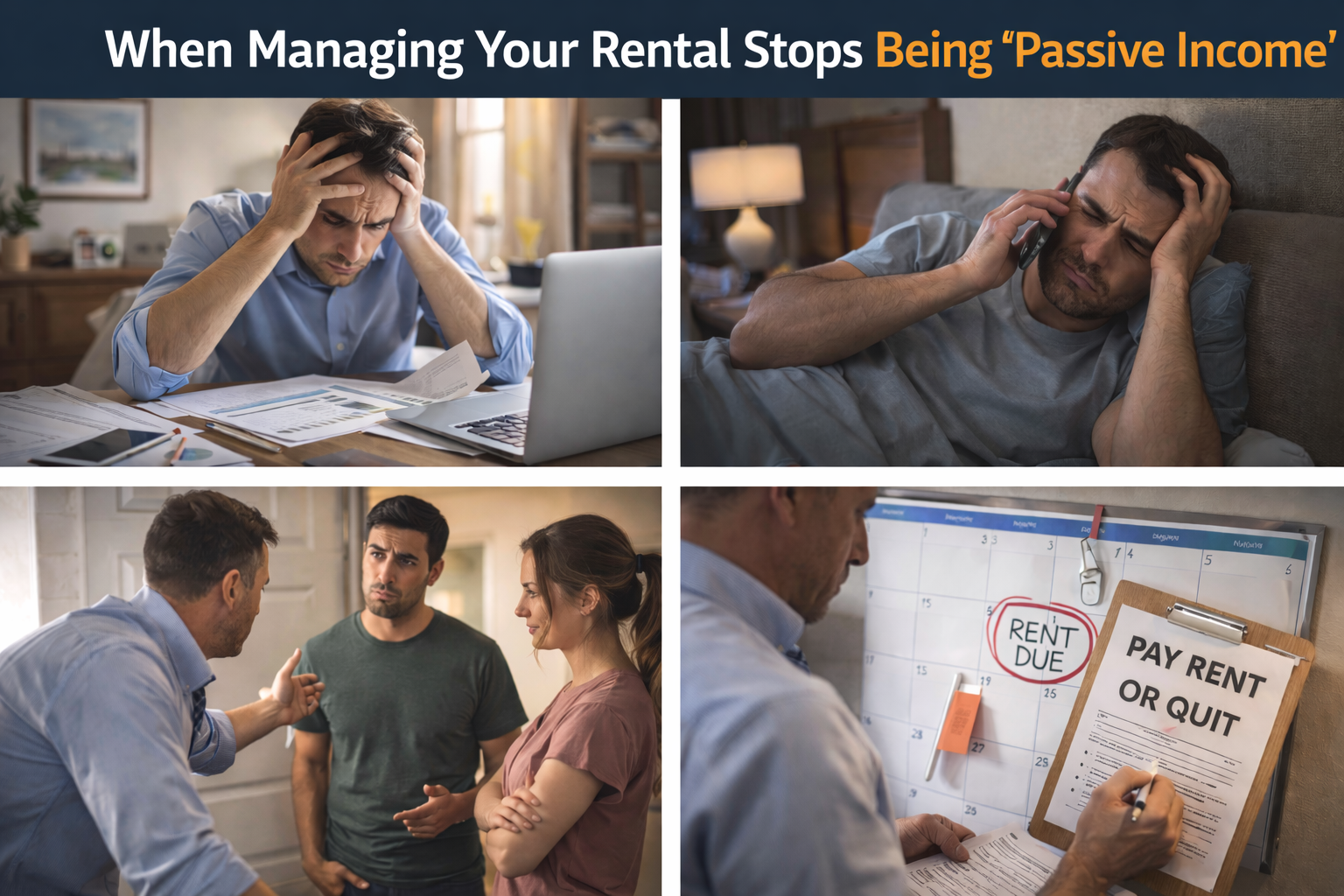

When Managing Your Rental Stops Being “Passive Income”

Real estate is often marketed as passive income—a hands-off investment that produces monthly cash flow with minimal effort. Many landlords buy their first rental property believing this promise, only to discover later that managing a rental can feel more like a second full-time job than a passive investment.

The truth is, rental property only remains passive until management demands outweigh the return. This article explains when and why managing your rental stops being passive income, the warning signs landlords often ignore, and what to do when ownership becomes more work than reward.

The Myth of Passive Income in Rental Real Estate

There is a version of real estate investing that can be relatively passive—but it rarely involves self-managing for long.

Self-managing landlords quickly take on roles such as:

Leasing agent

Maintenance coordinator

Accountant

Legal compliance officer

Customer service representative

Each role alone requires time and attention. Combined, they turn “passive income” into an active operation.

The First Warning Sign: Your Time Is Constantly Interrupted

One of the earliest indicators that your rental is no longer passive is constant interruption.

This often looks like:

Tenant texts during work hours

Emergency calls at night or on weekends

Repeated follow-ups for maintenance

Rent questions and disputes

When your phone becomes a 24/7 support line, your rental income is no longer passive—it’s demanding.

Maintenance Turns Passive Income into Active Work

Maintenance is one of the biggest factors that shifts rentals from passive to active.

Even minor issues require:

Diagnosing the problem

Contacting vendors

Scheduling repairs

Following up on completion

Managing invoices

As properties age, maintenance volume increases. What once felt manageable slowly becomes overwhelming.

Compliance and Legal Risk Add Hidden Work

California landlord-tenant laws are complex and constantly changing. Staying compliant requires ongoing attention.

Self-managing landlords must:

Track notice requirements

Handle security deposits correctly

Stay current on rent control laws

Document inspections and communications

Compliance work is invisible until something goes wrong—then it becomes urgent, stressful, and expensive.

Vacancy and Turnover Accelerate the Workload

Vacancy doesn’t just reduce income—it multiplies effort.

Each turnover creates:

Cleaning and repair coordination

Marketing and showings

Applicant screening

Lease preparation

If turnover increases, so does your workload. At that point, the property is no longer passive—it’s reactive.

Emotional Decision-Making Increases Stress

When landlords self-manage, emotions often enter decision-making.

Common scenarios include:

Giving tenants extra chances

Delaying rent increases

Avoiding difficult conversations

Putting off enforcement

These choices often increase workload and reduce income, making management even more hands-on.

Scaling Breaks the Passive Illusion

Many landlords can self-manage one property—for a while.

But as portfolios grow:

Tenant communication multiplies

Maintenance volume increases

Accounting becomes more complex

Legal exposure expands

At a certain scale, self-management stops being realistic without sacrificing time, focus, or sanity.

The Cost of “Free” Management

Self-managing often feels cheaper because there’s no management fee. But the true cost is rarely calculated.

Hidden costs include:

Time spent managing issues

Lost income from vacancy

Stress and burnout

Missed investment opportunities

When you factor in these costs, “free” management is often far more expensive than professional help.

When Passive Income Becomes a Business

The moment your rental requires systems, schedules, vendors, documentation, and constant oversight, it has become a business.

Businesses can be profitable—but they are not passive.

The key question becomes:

“Do I want to run a property management operation, or do I want to invest in real estate?”

How Professional Property Management Restores Passivity

Professional property management exists to return rentals to a passive state.

By delegating operations, landlords regain:

Time freedom

Predictable cash flow

Reduced legal exposure

Emotional distance from tenant issues

Instead of reacting to problems, investors can focus on strategy and growth.

Final Thoughts: Passive Income Requires Active Decisions

Rental property doesn’t become passive by accident—it becomes passive through intentional delegation.

When managing your rental stops being passive income, it’s not a failure—it’s a signal. A signal that your investment has grown beyond DIY management.

The most successful landlords recognize this moment and make the shift from operator to investor.